CoinEx Research Releases Landmark Report on the RWA Tokenization Revolution

From Infrastructure to Asset Adoption, CoinEx Research Maps the Rise of the On-Chain Real World Asset Era

HONG KONG, July 21, 2025 (GLOBE NEWSWIRE) -- CoinEx Research, the research division of global crypto exchange CoinEx, has officially released its latest in-depth two-part report: “Unlocking the On-Chain Asset Era: A Deep Dive into the Real World Asset (RWA) Tokenization Revolution (Part I & II).” The report systematically examines the RWA landscape—from foundational infrastructure and regulatory frameworks to the practical deployment of tokenized asset classes—and signals the arrival of RWAs as a core pillar of the next wave of financial innovation.

Key Insight I: The On-Chain Asset Era Is Accelerating

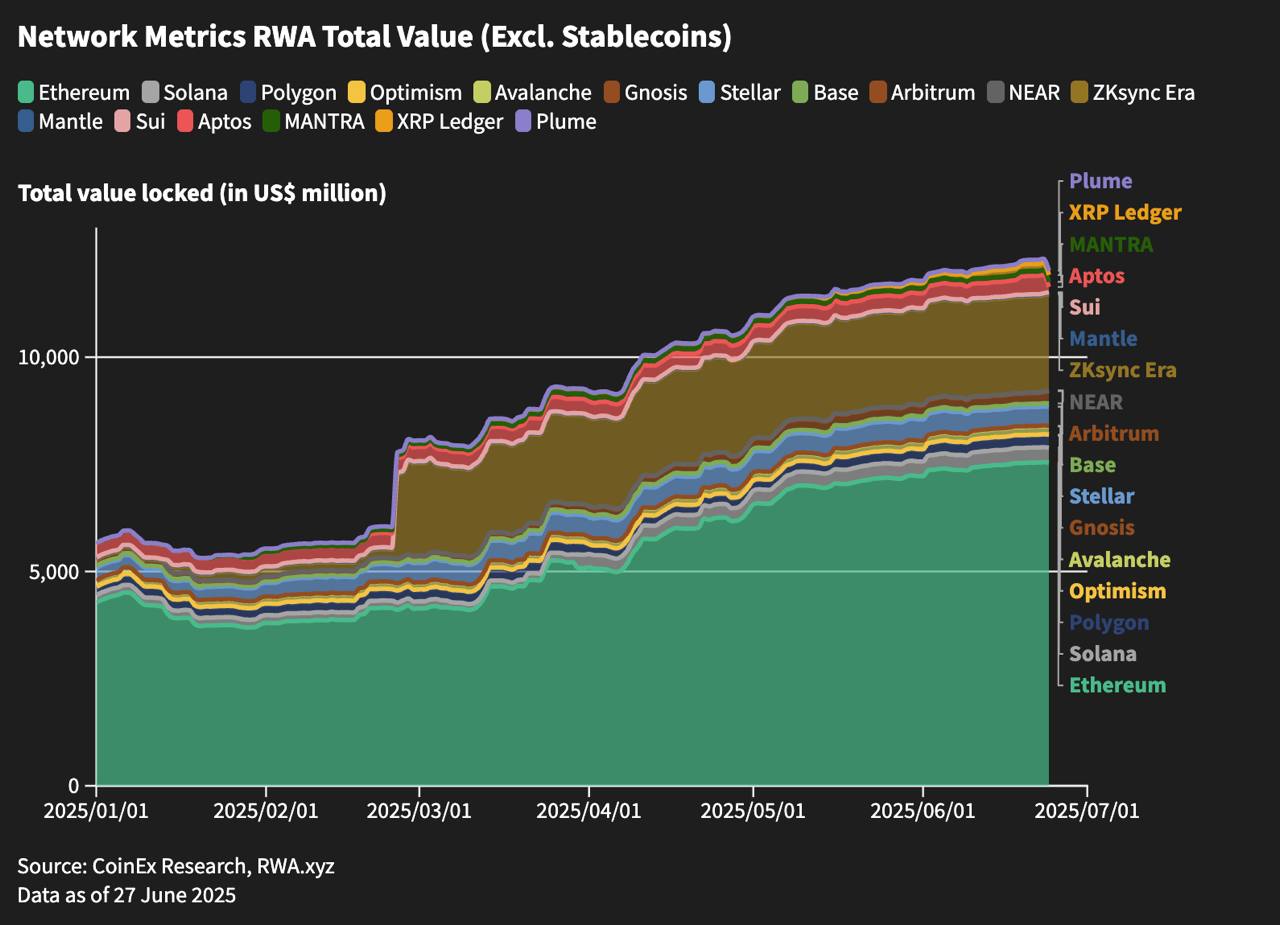

The report highlights that RWA tokenization is fast becoming the critical bridge between traditional finance (TradFi) and decentralized finance (DeFi). As of June 2025, RWA-related protocols have locked $12.7 billion in total value, up 69% year-to-date. Yield-bearing assets such as tokenized U.S. Treasuries and private credit are growing rapidly under clearer regulatory regimes, led by institutional giants like BlackRock and Franklin Templeton. Notably, BlackRock’s BUIDL fund alone commands 44% of the tokenized Treasuries market with $2.5 billion in TVL.

CoinEx Research believes RWAs are transitioning from early experimentation to institutional-scale adoption, marking a clear inflection point in the on-chain asset revolution.

Key Insight II: Five Core Asset Classes Define the Tokenized Financial Landscape

In Part II of the report, CoinEx Research analyzes five of the most impactful RWA asset types, detailing how each class is evolving in design, adoption, and regulatory complexity:

- Tokenized Treasuries: Regarded as the on-chain benchmark for “risk-free yield,” and the most compliant and composable asset class.

- Private Credit: High-yield with double-digit returns, though still nascent in risk management and legal structure.

- Tokenized Equities: Spearheaded by European platforms like Backed Finance, offering global retail access to stock markets with DeFi integration.

- Sovereign Bonds: Early pilots in France and Hong Kong under regulatory sandboxes exploring public debt tokenization.

- Commodities (Gold): Tokens like PAXG and Tether Gold are widely used as collateral across DeFi, linking real-world stability with on-chain liquidity.

CoinEx Research emphasizes that as compliance, yield, and liquidity converge, these asset classes will serve as foundational components of an on-chain financial system.

Key Insight III: Regulatory Clarity & Infrastructure Enable Institutional Entry

The report outlines two critical enablers for mainstream RWA adoption:

- Regulatory Pathways: Regulatory clarity has improved significantly. The U.S. SEC’s Reg D/S exemptions, the EU’s MiCA regulation, and the newly passed GENIUS Act in the U.S. have established formalized rules for RWA issuance and trading.

- Technical Infrastructure: Platforms such as Ethereum (dominant in RWA TVL), Securitize (for token issuance and KYC), and Chainlink (for proof-of-reserve oracles) form a full-stack foundation enabling compliant, programmable asset deployment.

Over 59% of non-stablecoin RWA value is currently hosted on Ethereum, underlining its institutional composability and regulatory alignment.

CoinEx Research’s Outlook: RWAs as the Foundation of On-Chain Capital Markets

CoinEx Research concludes that RWAs are not just symbolic tools—they are the building blocks of real on-chain capital markets. With scalable legal, custodial, and compliance systems in place, RWAs are now enabling institutions to enter Web3 with safety, efficiency, and clarity.

More than just the ability to “tokenize assets,” the real competitive edge will lie in delivering stable, composable, and transparent real-world financial instruments on-chain.

Read the Full Report

Both Part I and Part II of “Unlocking the On-Chain Asset Era: A Deep Dive into the RWA Tokenization Revolution” are now available on the official CoinEx Research portal. Industry professionals, institutional investors, developers, and policymakers are encouraged to explore the full insights.

Part I: Compliance, Infra & Institutions → the foundations of RWAs https://coinex.com/s/4EOE

Part II: Tokenized Treasuries, Credit, Equities & more in motion https://coinex.com/s/4EOL

About CoinEx

Established in 2017, CoinEx is an award-winning cryptocurrency exchange designed with users in mind. Since its launch by the industry-leading mining pool ViaBTC, the platform has been one of the earliest crypto exchanges to release proof-of-reserves to protect 100% of user assets. CoinEx provides over 1400 coins, supported by professional-grade features and services, for its 10+ million users across 200+ countries and regions. CoinEx is also home to its native token, CET, incentivizing user activities while empowering its ecosystem.

To learn more about CoinEx, visit: Website | Twitter | Telegram | LinkedIn | Facebook | Instagram | YouTube

Contact:

CoinEx

pr@coinex.com

Disclaimer: This content is provided by CoinEx. he statements, views, and opinions expressed in this content are solely those of the content provider and do not necessarily reflect the views of this media platform or its publisher. We do not endorse, verify, or guarantee the accuracy, completeness, or reliability of any information presented. We do not guarantee any claims, statements, or promises made in this article. This content is for informational purposes only and should not be considered financial, investment, or trading advice.Investing in crypto and mining-related opportunities involves significant risks, including the potential loss of capital. It is possible to lose all your capital. These products may not be suitable for everyone, and you should ensure that you understand the risks involved. Seek independent advice if necessary. Speculate only with funds that you can afford to lose. Readers are strongly encouraged to conduct their own research and consult with a qualified financial advisor before making any investment decisions.Neither the media platform nor the publisher shall be held responsible for any fraudulent activities, misrepresentations, or financial losses arising from the content of this press release. In the event of any legal claims or charges against this article, we accept no liability or responsibility. Globenewswire does not endorse any content on this page.

Legal Disclaimer: This media platform provides the content of this article on an "as-is" basis, without any warranties or representations of any kind, express or implied. We assume no responsibility for any inaccuracies, errors, or omissions. We do not assume any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information presented herein. Any concerns, complaints, or copyright issues related to this article should be directed to the content provider mentioned above.

A photo accompanying this announcement is available at:

https://www.globenewswire.com/NewsRoom/AttachmentNg/c2fa8ffd-7b25-4ed1-963e-8ed818514a23

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.